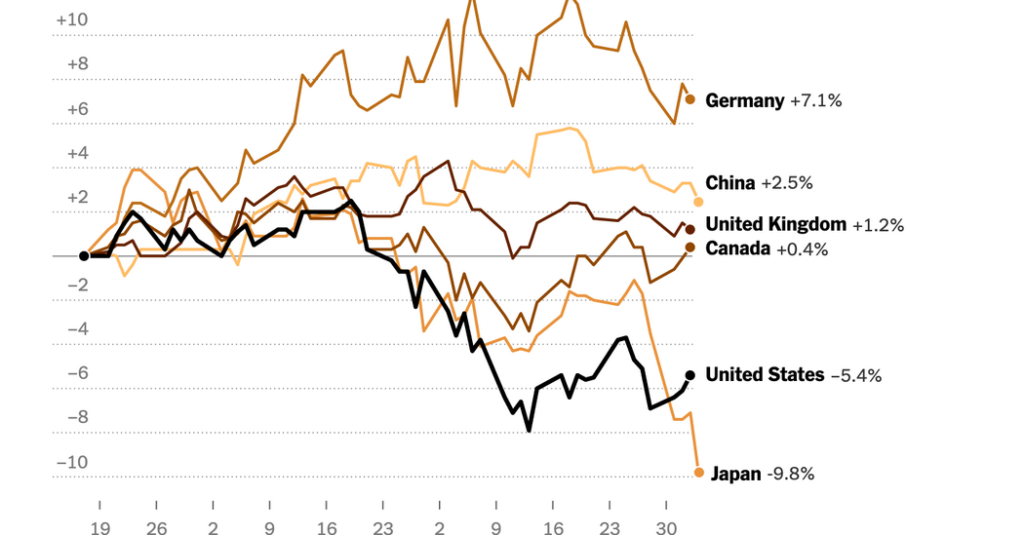

Markets around the world shuddered on Thursday after President Trump announced across-the-board 10 percent tariffs on all U.S. trading partners except Canada and Mexico, as well as even higher tariffs on dozens of America’s other main trading partners.

Futures on the S&P 500, which allow investors to trade the index outside normal trading hours, slumped over 3 percent. Asian markets fell sharply, with benchmark indexes dropping more than 3 percent in Japan, and nearly 2 percent in Hong Kong and South Korea.

The slide came after Mr. Trump, speaking at a ceremony at the White House on Wednesday, announced a new 10 percent base line tariff on all imports as well as country specific taxes on goods from a host of other countries. Those included a 34 percent tax on Chinese imports, on top of 20 percent in tariffs he recently put on China, and 20 percent on goods coming from the European Union and 24 percent on Japanese imports.

The initial market reaction suggested that the scale of the tariffs on Wednesday had come as a surprise, and analysts were still trying to figure out how the figures had been derived.

“I think the numbers are shockingly high compared to what people were expecting and it is inexplicable in many ways,” said Peter Tchir, head of macro strategy at Academy Securities. “I think it’s a disaster.”

The administration had adjusted its estimates of the tariffs imposed on the United States to include adjustments for what it deemed currency manipulation or even other taxes, with analysts questioning the analytical basis for doing so.

“Trump is going to war with countries on this,” said Andrew Brenner, head of international fixed income at National Alliance Securities. “It’s ridiculous. It shows no comprehension as to what he is doing to other countries. And it is going to hurt the U.S.”

Stock markets globally have been choppy in recent weeks, as investors have been whipsawed by the administration’s mixed tariff messages. Markets in Asia tumbled earlier this week ahead of the anticipated unveiling of tariffs, with Japan’s Nikkei 225 falling into a correction on Monday.

Japan was jolted again on Thursday, with analysts and trade experts in Tokyo caught off guard by Mr. Trump’s announcement of a 24 percent tariff on Japanese products. The U.S. ally’s average tariff on nonagricultural goods is approximately 2.4 percent, making it among the lowest in the world.

The uncertainty around the tariff levels has left investors unable to assess the potential ramifications for consumers, businesses and the broader economy.

“This ‘liberation day,’ I call it tariff-palooza,” said George Goncalves, head of U.S. macro strategy at MUFG Securities, speaking before Mr. Trump’s announcement, adding that “a lot of damage” had been done to the “psychology of this market.”

“This is meant to keep you guessing,” he said. “That’s part of the strategy.”

Through Wednesday, the S&P 500 had fallen 7.7 percent below its most recent peak in February. From that peak on Feb. 19 through the end of March, 10 of 11 sectors have fallen.

The Nasdaq Composite index, which is chock-full of the tech stocks that have come under pressure during the latest bout of selling, has tumbled even further, down almost 13 percent since its peak in December. Futures on the index tumbled over 4 percent Wednesday evening.

The Russell 2000 index of smaller companies more exposed to the ebb and flow of the economy, and therefore arguably more of a bellwether for American businesses, is more than 16 percent below its peak in November.

In Asia, the stocks of a wide range of companies including technology and semiconductor giants, as well as major auto exporters, stumbled. Shares of Japanese automakers Honda Motor and Toyota Motor fell more than 4 percent on Thursday, while South Korea’s Samsung Electronics fell close to 3 percent.

Japan’s Nikkei 225 index is down more than 11 percent this year, with analysts expecting a weaker dollar and stronger yen to cut deeply into the profits of big Japanese exporters.

Signs of worry have also been evident in the rapid rise in the price of gold. Investors have flocked to the precious metal, sending it 19 percent higher in the first three months of the year, its biggest quarterly rise since 1986.

And while many investors worry about the inflationary effect of tariffs, falling bond yields and a declining U.S. dollar suggest that most are more worried about waning economic growth.

The dollar slid as Mr. Trump spoke from the White House Rose Garden.

Some investors had hoped that the tariff announcement on Wednesday would cure some of the uncertainty in the financial markets. But few truly expected the news to mark the end of Mr. Trump’s tariff talk and with it an end to the stock market volatility.

Ahead of the announcement, prices in the equity options market, where investors can place bets that protect them against sharp moves in the stock market, suggested a consensus view that volatility would remain, said Mandy Xu, head of derivatives market intelligence at Cboe Global Markets.

“Investors no longer see tariffs as a one-time event risk, but an always-present risk,” she said, adding that the current expectation in the market is for volatility to persist, “given ongoing tariff and growth worries.”