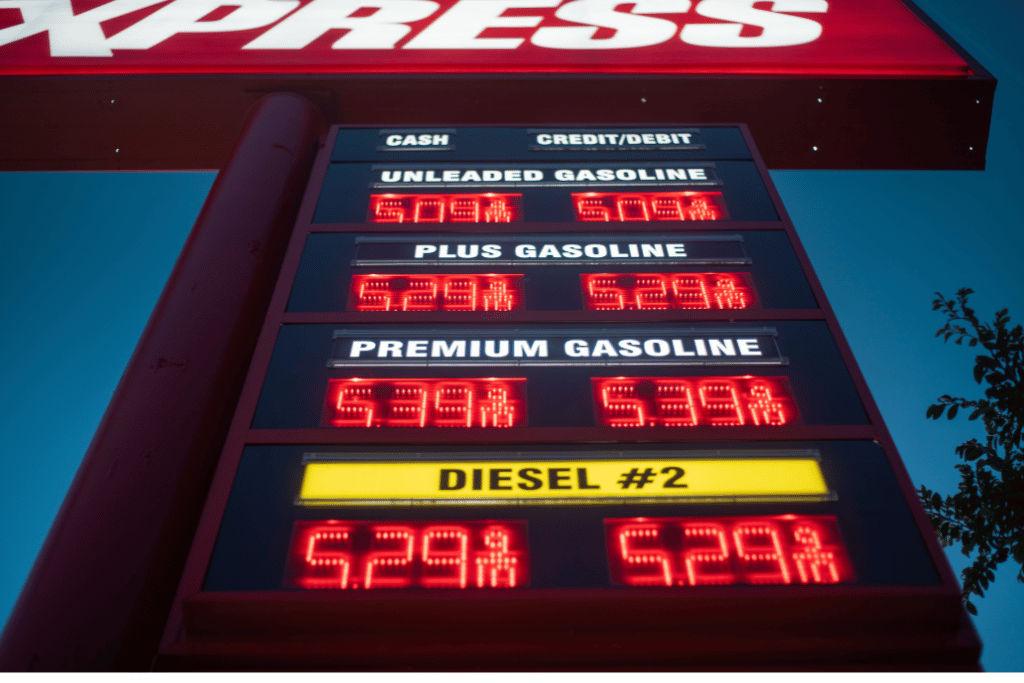

On the heels of my recent article outlining how California’s unique fuel regulations — not corporate price gouging — are driving up gasoline prices in the state, new developments have added urgency to that conversation.

On May 6, California Senate Minority Leader Brian W. Jones (R-San Diego) sent a letter to Governor Gavin Newsom sounding the alarm over what could become an energy and economic crisis in the state. Citing an analysis by University of Southern California professor Michael Mische, the letter warns that gas prices could spike 75% by 2026 — reaching as high as $8.43 per gallon — if two major refineries are allowed to shut down as planned.

This follows Professor Mische’s earlier study, which I referenced in my prior article. His research identified structural factors and policy-driven costs as the primary reasons California gasoline prices are consistently the highest in the nation — not oil company profiteering. These factors include high state taxes, a boutique fuel blend required only in California, and an increasingly constrained refinery landscape.

A Looming Supply Crunch

Two key in-state refineries are scheduled to close in the coming months: the Phillips 66 refinery in Los Angeles by the end of 2025, and the Valero refinery in Benicia by April 2026. Together, these facilities produce approximately 20% of California’s gasoline supply.

Professor Mische’s projections are stark. He estimates that gas prices could reach $6.43 per gallon after the first closure and climb to $8.43 by the end of 2026 after the second. These numbers assume stable crude oil prices. But if global oil markets turn volatile — as they often do — the ceiling could be even higher.

What’s Driving the Closures?

Refining gasoline in California has become increasingly difficult. The state’s stringent environmental rules, such as the Low Carbon Fuel Standard (LCFS), coupled with recent legislation like SBX1-2 and ABX2-1, have layered on costly compliance burdens. Add in uncertainty around future bans on internal combustion vehicles and a hostile investment environment, and it’s not hard to see why refinery operators are opting to exit the state.

The problem isn’t limited to fuel prices. According to Senator Jones’ letter, the closures would also eliminate around 1,300 direct jobs and nearly 3,000 more indirectly. These are good-paying, union and trade jobs in communities that can ill afford the loss. Beyond economics, the closures also increase the state’s reliance on imported fuel — most of which must be transported by ship — raising logistical risks and, arguably, national security concerns.

Why This Matters

The letter from Senator Jones reads as both a policy critique and a plea for realism. It challenges Governor Newsom to reconsider regulations that are squeezing fuel producers out of the state and proposes collaboration with the energy industry to explore solutions. Those could include tax incentives to maintain refining capacity, or temporary relief from some of the more onerous rules that disproportionately affect California refiners.

It’s important to understand that California’s fuel market is largely isolated. The state’s environmental regulations and fuel specifications make it difficult to import gasoline from other states or countries. When refineries close, there aren’t many viable alternatives. And when supply tightens in a market with limited flexibility, prices surge — sometimes dramatically.

Reframing the Debate

Much of the public and political dialogue around gas prices in California has focused on oil company profits and alleged price gouging. But the data simply doesn’t support that narrative.

Multiple independent investigations — including those by the FTC and the California Energy Commission — have found no clear evidence that refiners are colluding or manipulating the market. The price premiums in California are mostly structural, driven by policy choices.

Those choices may reflect environmental priorities, but they also carry economic consequences. Policymakers must grapple with this trade-off, especially as the state’s energy mix continues to evolve.

The Bottom Line

If California continues down a path that discourages in-state refining while failing to address the growing supply gap, residents should brace for more sticker shock at the pump. Gasoline prices of $8 or more per gallon are no longer hypothetical; they are within view if the state doesn’t take action.

To be clear, this is not an argument against clean energy. California can pursue its climate goals and still maintain a stable, affordable energy supply. But doing so will require pragmatic policies that ensure reliability and economic viability — not just ambition.

As I wrote in my previous article, this isn’t about corporate greed. It’s about structural and regulatory decisions that have real-world consequences for working families, small businesses, and anyone who drives a car in California.

The choice isn’t between climate progress and affordable fuel. The choice is whether we make that transition responsibly — or let the market punish those who can least afford it.

By: Oil Price / June 17, 2025