Last year, 1 Finance Magazine surveyed 1,655 bank relationship managers (RMs) from 20 scheduled commercial banks across 15 states to examine the workplace pressures faced by these professionals and assess their understanding of the financial products they were selling. Banks have access to detailed financial profiles of crores of customers, giving them an advantageous position compared to other financial advisors or product distributors.

As the primary link between the bank and its customers, RMs are entrusted with the responsibility of building trust and providing sound financial advice. However, our survey uncovered a concerning trend where RMs are compelled to meet unrealistic sales targets by mis-selling financial products.

Why do banks in India aggressively sell insurance?

According to the survey by the 1 Finance Magazine:

1) 57.6% of RMs admitted they were explicitly instructed to sell directed financial products at any cost, even if better products existed.

2) 84.3% reported their workplace pressure at 3 or more on a scale of 0 to 5 (5 being the highest).

3) 51.5% confessed to fearing termination if they failed to meet their sales quotas.

As a result, many RMs felt compelled to sell insurance policies, even when they knew superior alternatives existed for their customers.

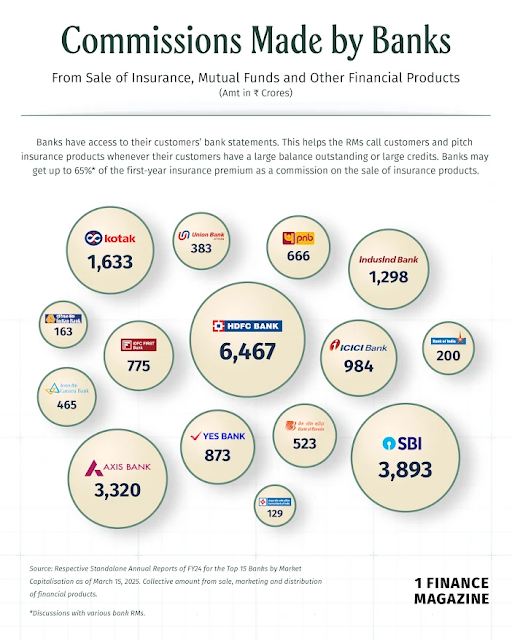

According to 1 Finance magazine, the top 15 banks by market capitalisation generated ₹21,773 crore from selling insurance, mutual funds and other third-party financial products in FY24 alone.

Source: 1 Finance Magazine

Banks may earn as much as 65-70% commission on first-year premiums from selling insurance policies, including the policies manufactured by their related-party companies. This creates a clear conflict of interest, where the priority shifts from recommending the best financial products to customers to promoting products that maximise the bank’s profits. This bias is evident, as the products offered by affiliate companies may not always align with the best interests of the customer.

This is concerning because, according to 1 Finance Magazine, in FY24, 52% of the individual new business premiums underwritten by private life insurance companies were sold through banks.

How do bank commissions affect customer choices in financial products?

When asked about the commission structure for selling traditional insurance plans, bank RMs revealed that they receive up to 65% of the first-year premium revenue from such products. In contrast, selling a mutual fund instead may yield only 1%.

This lucrative commission structure explains why traditional plans and Unit-Linked Insurance Plans (ULIPs) are predominantly sold, despite the fact that these products tend to offer low returns to customers. Banks, motivated by the substantial commissions, pressure RMs to push these products.

As a result, customers are pushed towards insurance products more than mutual funds or other products that may be more suitable for the customers.

According to the Insurance Regulatory and Development Authority of India (Expenses of Management of Insurers Transacting Life Insurance Business) Regulations, 2023, commissions, including other expenses of management, from first-year premiums can constitute up to 80% of the policy cost, while renewal premiums can attract up to 17.5%.

These figures explain why RMs are incentivised to sell regular premium plans, as they provide ongoing commissions. However, if customers cannot afford to pay these premiums, their deposited amounts may be forfeited, or they may receive only a partial refund.

Under the SEBI TER Regulations, mutual funds offer a fee structure with lower expense ratios, making mutual funds a more cost-efficient option for customers. But the absence of hefty commissions in mutual funds results in a lower promotion by RMs compared to insurance products.

1 Finance has made a documentary highlighting the rampant mis-selling of financial products and how it impacts our lives. Watch the trailer here.

An awareness initiative by 1 Finance

How do commission structures influence the sale of insurance vs. mutual funds?

Banks and other agents earn much higher commissions from selling traditional life insurance plans and ULIPs compared to mutual funds. For a 5-year tenure policy, the commission on traditional insurance plans can be as high as 55.6% of total earnings. Whereas hybrid mutual funds offer much lower commissions, around 1.3% for a 30-year tenure.

Source : 1 Finance Magazine

Commissions vary across different products and offer lucrative incentives for selling traditional insurance plans and ULIPs over mutual funds.

What is the impact of mis-selling on life insurance policy lapse rates?

The mis-selling of traditional insurance plans has led to a high rate of policy lapses within five years. Below is a table showing the persistency ratio of the top 10 life insurers by revenue in FY24:

Persistency ratio of life insurance policies (Top 10 life insurers)

Source: 1 Finance Magazine

The data of the top 10 life insurers reveals that by the 61st month (five years), on average, 49%, or nearly half of all policies, had lapsed, highlighting the inefficacy of the products sold to the customers.

One of the possible explanations for this high lapse rate is that the policies were mis-sold. The customers may have realised that the products were unsuitable for their needs or that they could not afford the premiums. This aligns with the survey’s findings, where RMs admitted to knowingly selling products that were not in the best interest of the customer.

Conclusion

Mis-selling in India’s banking sector is driven by unrealistic targets and high commission incentives. Despite regulatory efforts, the practice continues, largely due to pressure to meet quotas and the lack of financial product knowledge among RMs. This has led to widespread consumer dissatisfaction and financial losses. For meaningful change, banks must realign incentives, ensure proper training and enforce stricter oversight to prioritise customer interests over profit.