If you have ever walked into a bank or sat down with an insurance agent only to feel pressured, confused, or outright deceived, you are not alone. Consider the recent experience of a close acquaintance who, in trying to invest his savings in banks, was persuaded to invest in “the best plan”, a product that included crippling hidden charges and a strict, undisclosed lock-in period. This is the dark reality of financial mis-selling, an all-too-common epidemic in India.

According to the Insurance Regulatory and Development Authority of India (IRDAI) Annual Report 2023-24, a staggering 2,15,569 insurance-related complaints were filed. Of these, nearly one in five (18.73%) were directly linked to unfair business practices, including mis-selling. These figures reflect the individuals who realised they were deceived; countless others likely remain unaware they have been taken advantage of until it’s far too late.

The promise of a secure financial future often leads unsuspecting investors into a minefield of hidden charges, misleading plans, and aggressive sales tactics. This article will equip you to spot the red flags, recognise pressure tactics, and identify exactly when you are being mis-sold a financial product. Your hard-earned money deserves better than a hidden-charge trap.

What is financial mis-selling?

Financial mis-selling happens when a product is pushed using misleading tactics, incomplete information, or exaggerated claims, convincing someone to buy what they don’t actually need. Here, sellers twist the sales pitch to make the customer “fit” for the product, not the other way around.

The motivation behind this action is clear: COMMISSIONS! Banks and insurance companies often operate on commission-based models.

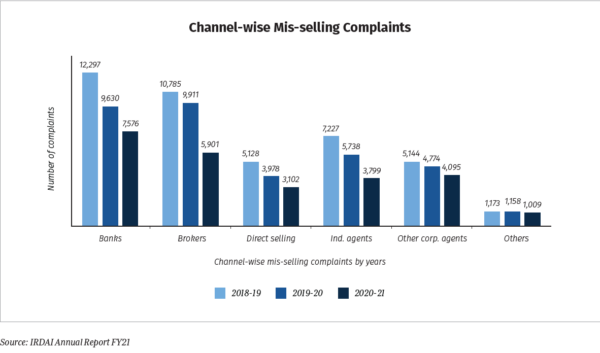

1 Finance Magazine highlights the scale of this problem.

The chart shows channel-wise mis-selling complaints received by IRDAI between 2018 and 2021. However, IRDAI stopped giving this disclosure in its annual reports after 2021. The numbers clarify that financial mis-selling in India is a systematic issue that needs to be addressed, bringing attention to the financial products.

Commonly mis-sold financial products in India

Every product is built with a unique purpose, but when that purpose is twisted for earning commissions, you end up with the one that’s just wrong for you. Hence, you must have an idea about these commonly mis-sold financial products in India.

1. Mis-selling of insurance policies

An insurance policy is meant to provide protection and stability, not high returns. Yet, many people are told, “This plan works better than any other scheme. It is an investment with guaranteed returns.” And they end up buying endowment plans, which combine insurance with investment, locking your money.

2. Mis-selling of unit-linked insurance plans (ULIPs)

Agents often pitch unit-linked insurance plans (ULIPs) as better alternatives to mutual funds with a promise of doubling your money. However, these plans mix insurance and market-linked returns, and they come with high costs and long lock-ins. Unlike mutual funds tailored to your goals and risk profile, ULIPs blur the lines and leave investors trapped in a product they never clearly understood.

3. Mutual funds mis-selling

Many mis-sellings happen during tax season. Imagine a rushed investor being told, “This ELSS fund will save your taxes and give better returns.” With little time to research, the investor signs up without understanding its needs and risks. Similarly, unsuited thematic funds and new fund offers (NFOs) are often pushed the same way, promising novelty but hiding the risks. Such rushed decisions could derail your goals.

4. Credit cards mis-selling

You applied for a specific credit card but was instead enrolled for a different one without clear consent. The sales agent assured you that the card could later be modified after issuance, but later it came with additional charges. These products are quietly added in during other transactions. What feels like a minor slip at first often snowballs into hidden charges or penalties.

5. Personal loans mis-selling

When banks market personal loans, they highlight “easy approval and quick cash.” What stays hidden are the high interest rates and debt traps that follow. Customers walk in expecting short-term relief without realising they are carrying a long-term burden.

6. Bundled products mis-selling

Sometimes, products come packaged in a way that hides the true cost. For example, opening a savings account that automatically links to insurance, cards, or investment products. By the time the customer realises, they are paying for services they never wanted in the first place.

7. Chit funds

Chit funds are often marketed as a safe community saving tool with quick payouts. An organiser maintains that fund, which collects money from various people. Every time, a lucky draw chooses a name who receives the entire money. In such a way, this process continues until every person involved receives the entire amount at least once. In reality, such funds are unregulated and prone to fraud. They collapse when organisers vanish with the collected money.

8. PMS and “exclusive wealth builder” schemes

Portfolio Management Services (PMS) are sometimes pitched to middle-class investors as a ticket to elite wealth building. What isn’t transparent is the high minimum investment and entry fees, and the fact that PMS strategies often carry higher risks than mutual funds. Many customers sign up expecting exclusivity but end up with unplanned risks.

Problems customers face due to mis-selling

1. Loss of your capital

The clearest damage is losing hard-earned money to products that don’t fit your goals. Mis-selling pushes customers into buying unsuitable products like buying high-risk plans disguised as safe options. Or like in many cases, convincing customers to invest in an endowment plan that locks their savings, which can see potential losses.

2. Liquidity issues in case of emergencies

Locked-in funds often leave customers helpless during emergencies. A hospital bill or urgent family need can’t wait for a 15-year lock-in to expire. Mis-sold products not only fail to serve goals but also actively lock access to money when it’s needed most.

3. Loss of trust with psychological toll

The deepest cut is emotional. Once cheated, customers hesitate to trust even genuine financial products, leading to missed opportunities. That old acquaintance’s case is a reminder: his savings became inaccessible, and with it went his financial peace of mind. For a retiree, it’s the loss of the relaxed, worry-free life they had earned.

So, how to identify you are being mis-sold a financial product

If you nod along to any of these, chances are you have already been mis-sold a financial product.

- Were you promised higher or guaranteed returns?

Statements like “Your money will double in five years; we guarantee it” sound tempting but are often unrealistic sales pitches. Very few financial products, such as fixed deposits, can genuinely guarantee returns. If you hear terms like “guaranteed returns,” it’s time to become curious. Ask for details about the financial product: Who is providing the guarantee? What is the guaranteed rate of return? Is there a specific lock-in period associated with that product?

- Were you asked to buy one product to get another?

For example, being told “Take this property insurance, and we will approve your home loan” is not advice, but a classic bundling trick that coerces you into buying a product you don’t need. According to the Reserve Bank of India, property insurance is not compulsorily required for a home loan.

- Were you sold something that didn’t match your financial personality?

If you are a cautious investor but were offered high-risk products, you were given an inappropriate product. Any financial product must align with your financial personality including your risk appetite. Selling high-risk products to risk-averse clients means exposing your hard-earned savings to potential losses.

- Were you lured with freebies or cashback from an agent?

Cashbacks, gifts, or freebies usually mean the agent’s commission comes first, not your interest. Agents are motivated by higher commissions and not your financial well-being. Such tricks can cloud your judgement, where you end up buying a product that proves profitable to the agent.

- Were you told something misleading about the product?

For example, a discount health card being sold as “health insurance.” That’s a misrepresentation in plain sight. Although both sounds similar, they differ in terms of coverage and benefits. A health card may give discount benefits only on a few, selected companies, while a genuine health insurance can give financial protection against medical bills, hospital stays, etc.

- Were you pressured with urgency to buy immediately?

Pressuring someone with a “last day offer” or “policy closes tonight” is a sales tactic. Legitimate financial products don’t vanish or expire overnight. The agents prey on the gullible customers by using such high-pressure sales tactics.

Cement this golden rule in your mind. If you feel rushed, manipulated, or cornered, pause and re-check before signing anything to protect yourself from mis-selling.

How to protect yourself from financial mis-selling

Use this checklist to protect yourself from mis-selling practices.

- Be financially aware

Treat financial products like your medicine. You wouldn’t take a pill without confirmation, right? Similarly, ensure you understand the product and always read the documents carefully. Never rely only on verbal promises of any agent.

- Ask the right questions

- What are the risks?

- What is the lock-in period?

- What are the exit options?

- Match product to your needs

- Does this financial product suit your goals?

- Does it fit your time horizon?

- Does it match your risk appetite?

- Review the sales process

- Were you pressured into buying quickly?

- Did they ask about your goals, income, or risk profile?

- Do you understand where your money is invested?

- Did the agent disclose charges and risks?

- Was the product explained clearly?

- Are you unable to exit the product without heavy penalties?

- Know the regulators

The regulators in India have a grievance redressal system for reporting mis-selling.

Conclusion

Suitability is the keyword. A financial product that works for your neighbor may not work for you. Consult a Qualified Financial Advisor (QFA) if you require help. He will understand your financial personality, goals, and risk tolerance, and advise you on a plan of action accordingly.

Remember, investing in a financial product without first-hand knowledge is like driving with your eyes closed. What we can learn from the close acquaintance is to never sign anything without reading. The financial world comes with plenty of opportunities as well as traps. The best defense against mis-selling isn’t avoiding financial products; it’s when we hand over decisions blindly.