Many investors tend to believe commercial real estate sits behind high walls, reserved only for large institutions. That changed with the introduction of the real estate investment trust (REIT), which gave access to countless retail investors. Brookfield India REIT stepped into a market where earlier REITs had already introduced the concept to investors. But, it need not be the first mover to become a meaningful player.

Brookfield REIT entered with a portfolio that encouraged the need for scale and global-grade execution. Its presence helped broaden participation by offering exposure to Grade A offices backed by global expertise. As a result, investors noticed the consistent execution and began viewing the REIT not as a newcomer, but as a serious investment capable of sustaining long-term value.

The shift in perception set the stage for a deeper look at what this REIT truly offers.

All you need to know about Brookfield India REIT

Established on July 17, 2020, under a trust deed, this SEBI-listed REIT’s units started trading publicly on the National Stock Exchange of India (NSE) and the Bombay Stock Exchange (BSE) from February 16, 2021. What immediately distinguished it from peers was its structure. It became India’s only 100% institutionally managed office-space REIT, backed by a single global sponsor instead of multiple owners.

What Brookfield India REIT owns and manages?

The REIT’s strength lies in the quality, scale, and strategic placement of its assets. Its portfolio comprises ten Grade-A office assets across India’s major cities, including Mumbai, Gurugram, Kolkata, Ludhiana and Noida.

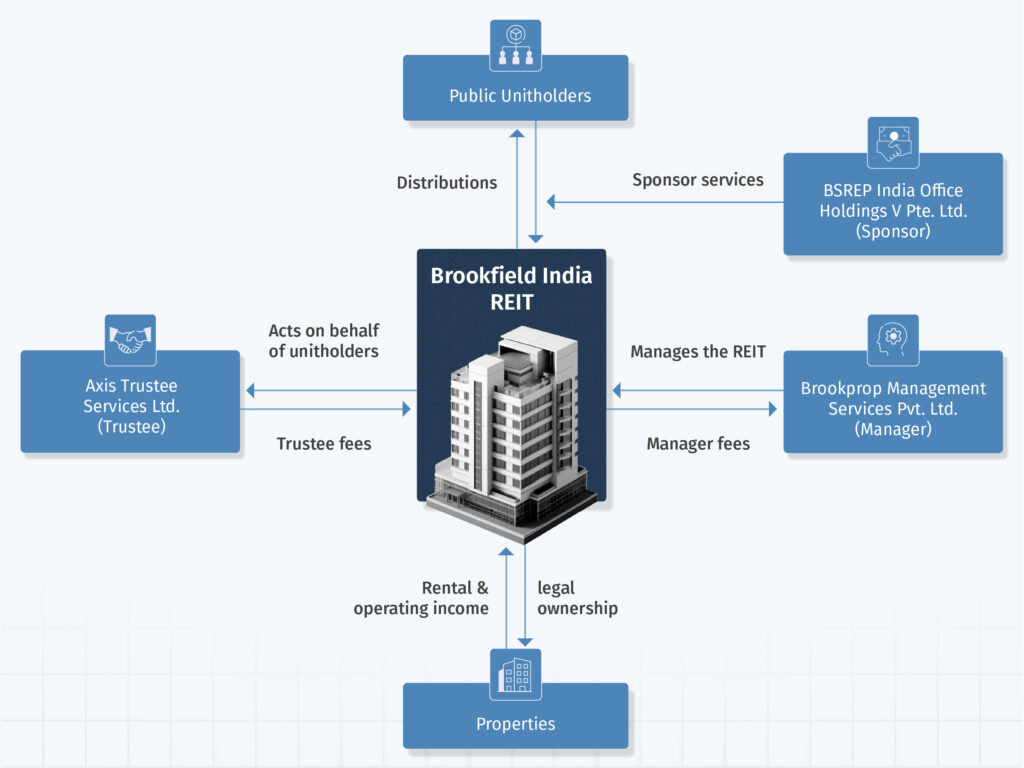

Structure of Brookfield India REIT

An overview: Brookfield India REIT Q2 FY2026

- The gross asset value (GAV) stands at Rs 39,600 crore, due to stronger valuation and improved operating performance.

- Total leasable area stands at about 29.1 million square feet (msf). Out of that, roughly 24.6 msf is completed and operational. Around 0.6 msf is under construction, plus additional 3.9 msf is earmarked for future development.

- The portfolio earned a 5-star rating for the fourth consecutive year. It also secured the top rank in Asia/Listed Global Sector Leader, achieving a perfect score of 100/100 in the development category.

This let us know that Brookfield REIT is a carefully curated portfolio of high-quality, large-scale office parks.

What makes Brookfield REIT attractive

1. Backed by a globally trusted sponsor

Brookfield Asset Management, one of the world’s largest alternative asset managers, backs the REIT. That adds financial depth, global execution capability, and strict governance. For you, this reduces operational risk. You are not depending on an unknown developer, but one a global institution that runs real estate as a business.

2. Grade-A campuses in top cities

The REIT doesn’t dabble in single, standalone buildings. It focuses on integrated office campuses with amenities, scale, and modern layouts. Exactly what multinational tenants and global capability centres (GCCs) want. And the numbers reflect this demand.

Q2 FY2026 saw ~5.92 msf of gross leasing, with 46% of it coming from GCCs. These centres now contribute ~37% of the REIT’s total portfolio.

Such multinational companies sign mutli-year leases, adding a defensive layer to your portfolio.

3. Steady income backed by strong tenants

Because the underlying tenant base consists of large, multinational corporations operating in high-demand markets, the REIT enjoys predictable cash flows. This directly supports consistent distributions to unit holders. Plus, growth in occupancy, market rents, and asset value adds further.

Brookfield India REIT reported a net operating income of ₹509.4 crore, a 12.9% year-on-year jump from Q2 FY2025 result, driven by higher occupancy levels. On the back of this strength, the REIT announced a total distribution of ₹655.1 million (₹10.50 per unit).

4. Good credit rating signals financial strength

Brookfield India REIT holds the highest ratings: ICRA AAA (Stable) and CRISIL AAA/Stable ratings. This signals extremely low credit risks. For you, this means the REIT is seen as financially strong, has stable cash flows, and is highly reliable in meeting its debt commitments.

5. Long-term growth anchored in high-quality portfolio

Brookfield India REIT also offers clear growth visibility. It operates a nearly 30 msf portfolio with committed occupancy at 90%. The weighted average lease expiry sits at roughly 6.6 years, giving investors long-term income stability. Add to that a 4.5 msf development pipeline, both under construction and planned, and the REIT has enough built-in expansion to grow organically, without depending on aggressive new acquisitions.

What investors should watch out for

1. Execution risk in ongoing and planned developments

Development pipelines offer expansion opportunities, but they also carry a long list of execution risks. Any construction delays, contractor issues, rising material costs, or regulatory approvals can all push timelines out. As a result, projected rental income gets deferred. This creates uncertainty in cash-flow timing, making future distribution less reliable.

2. Broader economic challenges

Office demand does not move independently of the economy. Hiring trends and corporate growth plans feed directly into leasing decisions. Otherwise, they don’t commit to new space and renewal negotiations become far more cautious. This means slower rent escalations and higher likelihood of vacant floors at renewal cycles. You must recognise that this asset class amplifies whatever the macro environment is doing.

3. Lease renewal risk

Over time, as leases expire, tenants may decide not to renew or negotiate lower rents. Any of the outcomes can affect occupancy levels and weaken overall yields, making lease renewal a critical factor in long-term REIT performance.

Who can invest in Brookfield India REIT?

Consider investing if:

- You prefer a stable income stream backed by long-term Grade A corporate tenants.

- You believe the commercial office market in India will remain resilient over the next decade.

- You are comfortable with moderate volatility.

Be cautious if:

- You are expecting high-yield in the short-term period.

- You prefer avoiding exposure to the cyclical nature of the office market

- You are uncomfortable with a REIT that actively engages in development and expansion activity.

How to invest in Brookfield REIT

You can invest in Brookfield REIT directly by logging into a trading portal. If you don’t have one, opening it takes just a few steps using KYC. Then, search for Brookfield India REIT by name or ticker (NSE: BIRET & BSE: 543261) and place your buy order. Since REITs trade on the stock exchange like individual shares, you can buy or sell units throughout market hours, offering flexibility and liquidity.

Another way is through mutual funds or ETFs that include Brookfield India REIT in their portfolios. This lets you tap into the benefits of commercial office real estate while spreading your risk across multiple assets.

How Brookfield India REIT can fit into your asset allocation

Brookfield India REIT suits a long-term portfolio when the investor understands exactly what role it serves. It offers indirect ownership in premium quality office properties. However, it doesn’t replace the need for proper asset allocation and clarity about your risk appetite. Incorporating a REIT requires thoughtful planning. Overexposure to real estate, misallocations, or even neglecting its tax implications (if any) can seriously undermine your overall financial strategy. Similarly, investing by yourself also comes with risks, poor diversification or misjudging your own risk tolerance. You may end up making costly mistakes.

As always, consult a Qualified Financial Advisor (QFA) to evaluate Brookfield REIT’s place in your portfolio. His regulated expertise can help you make asset allocation decisions based on logic rather than assumptions. He will study your risk tolerance, current holdings, and how much income stability matters in your long-term plan. So, talk to an advisor to curate your financial plan.

Today, Brookfield India REIT has become a vital force in reshaping how investors view commercial real estate. Whether it complements your portfolio or not remains with your overall planning.