The discounted cash flow (DCF) model is one of the most comprehensive valuation methods for estimating a company’s worth. Valuation determines a company’s current value by analyzing financial forecasts of its profits, typically through dividends or cash flows. Another useful valuation method is the discounted dividend model (DDM). Both DCF and DDM focus on understanding present value by projecting future earnings.

“Within a company, well-informed valuation enables managers to make wiser decisions regarding capital budgeting and strategic planning,” says Harvard Business School Professor Suraj Srinivasan in the online course Strategic Financial Analysis. “Outside the company, investors need to measure value to assess the risks and returns of their investments with greater confidence.”

Free Guide: Financial Terms Cheat Sheet

Access your resource today.

DOWNLOAD NOW

What Is Discounted Cash Flow (DCF)?

The discounted cash flow (DCF) model estimates a company’s intrinsic equity value by discounting projected future free cash flows to equity (FCF ͤ) using the time value of money principle.

To break that down:

- Equity value: The total value of a company’s shares, representing shareholder ownership

- Present value: The current value of an expected future financial return, usually a sum of money; it’s what your future money would be worth today

- Free cash flow to equity (FCF ͤ): Funds available to shareholders, regardless of whether they’re distributed; this differs from dividends, which a company must return to its shareholders

- Time value of money: The principle that a sum today is worth more than in the future due to its potential earning capacity

“A DCF analysis is useful when investing money now and expecting some rewards in the future,” Srinivasan says in Strategic Financial Analysis. “A DCF analysis finds the intrinsic value of a business, which is the present value of the free cash flow the company is expected to pay its shareholders in the future. If the intrinsic value is higher than the current price, it could be a good investment opportunity.”

Related: Discounted Dividend Model (DDM): What It Is and How to Use It

How Does Discounted Cash Flow (DCF) Work?

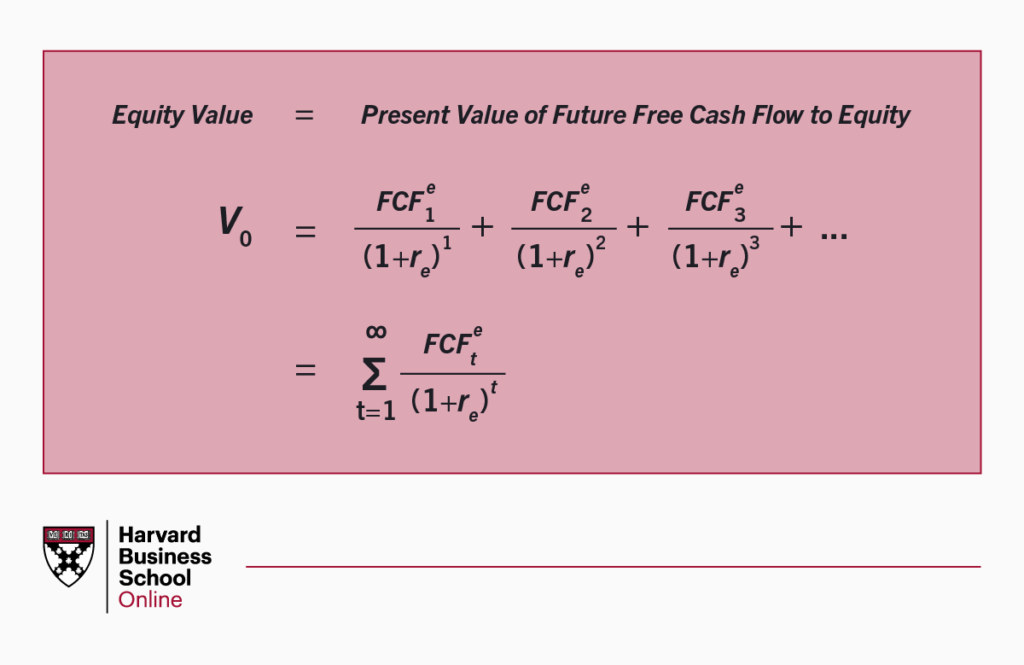

Strategic Financial Analysis teaches the DCF equation, which is:

Equity Value = Present Value of Free Future Cash Flow to Equity

V₀ = FCF ͤ₁ / (1+ re )¹ + FCF ͤ₂ / (1+ re ) ² + FCF ͤ₃ / (1+ re )³ + …

= ∑ from t = 1 to ∞ FCF ͤₜ / (1+ re )ᵗ

Despite its complexity, DCF follows a recurring formula summed over multiple years. Here’s a breakdown of the equation’s components:

- V₀ = The company’s equity value, or the value of all its shares

- FCF ͤ = Estimated future free cash flow of a specific year within your timeframe

- re = The discounted rate of return for that period

- t = The number of years you’re estimating for, usually five to 10

Steps to Perform a DCF Analysis:

- Estimate your company’s free cash flows to equity (FCF ͤ) over a defined period, typically five to 10 years.

- Forecast the company’s value beyond the terminal year—the last year of the forecast horizon. This is known as your company’s terminal value.

- Establish the discount rate (rₑ ), often based on either the cost of equity or the weighted average cost of capital (WACC). This accounts for the required return by investors.

- Discount the future cash flows to their present value using the time value of money, then sum them to determine the company’s intrinsic equity value.

The terminal value represents a company’s expected stable growth rate beyond the forecast period. To determine your company’s terminal value, you can use a simplified equation called the Gordon Growth Model:

Present Value of Stock = V₀ = FCF ͤ / re – g

This equation starts with the estimated future free cash flow of the first year after your specified time frame (FCF ͤ). Then, it’s divided by the difference between the discount rate (re) and the estimated growth rate (g).

How to Calculate Discounted Cash Flow

Imagine you’re considering buying an apple tree for $200. You estimate that the tree’s apple production will create $100 in FCF ͤ each year and want to determine if your investment is better spent on apple trees or elsewhere.

Since money today is worth more than money in the future, you must discount future cash flows. If your discount rate is 10 percent, you can calculate DCF as follows:

Year 1 apples: $100 / (1+0.1) = $90.91

Year 2 apples: $100 / (1+0.1)² = $82.64

Year 3 apples: $100 / (1+0.1)³ = $75.13

Year 4 and beyond apples: $100 / (0.1) = $1,000

As you go through the formula, you’ll notice the denominator you’re raising increases exponentially due to the compounding effects of the discount rates year over year.

Once you’ve calculated your present values of each year’s cash flow, you add them together:

$90.91 + $82.64 + $75.13 + $1,000 = $1,248.68

Since the total present value ($1,248.68) exceeds the cost of the tree ($200), the investment is worthwhile.

DCF Benefits and Drawbacks

When calculating discounted cash flow (DCF), determining the discount rate involves various financial models, including the cost of equity and the weighted average cost of capital (WACC):

- Cost of equity, also known as the cost of equity capital (Re): The return shareholders require to invest in a company’s stock. It’s often determined using the capital asset pricing model (CAPM), which adds the risk-free rate to a premium based on the stock’s sensitivity to market movements, known as “beta.”

- Weighted average cost of capital (WACC): The company’s overall cost of capital, representing the average return expected by shareholders and lenders

Because DCF relies on future performance estimates, it’s highly sensitive to even small assumption changes—making precise discount rate estimation critical.

Using DCF to Evaluate Future Valuations

By valuing future cash flows, you can make more strategic investment decisions. The discounted cash flow (DCF) model helps estimate your company’s intrinsic value now and in the future.

You can deepen your understanding of DCF and other valuation methods, including the discounted dividend model (DDM), by taking an online finance course like Strategic Financial Analysis. The course explores the intersection of accounting, strategy, and finance through interactive exercises and real-world business examples to enhance your learning.

Ready to strengthen your financial management, analysis, and decision-making skills? Explore Strategic Financial Analysis—one of our online finance and accounting courses—to leverage financial insights to drive strategic decision-making. Get a jump start by downloading our free Financial Terms Cheat Sheet.