Nexus Select Trust is India’s first retail-focused REIT, built entirely around income-producing malls, shopping centres, and large organized retail destinations. Unlike office REITs that rely on corporate leasing cycles, this one is anchored in consumer-driven approach and long-term relationships with established brands. Its portfolio consists of institutional-grade retail assets with stable occupancy and predictable cash flows.

If you are considering adding a retail-heavy income asset to your portfolio, Nexus Select Trust REIT might look like a fit. But before you even think about including it, you need to examine its financial strength, cash-flow stability, and whether its risk-reward profile aligns with your goals.

All about Nexus Select Trust REIT

Nexus Select Trust entered the market with assets that were already part of everyday life. They were fully operational retail destinations where people shopped, dined, and spent time long before becoming investment assets. That starting point matters because it shapes how income is earned and how risks are managed over time.

The Nexus Select Trust REIT was registered with the Securities and Exchange Board of India (SEBI) on September 15, 2022 and listed on both National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in May 2023.

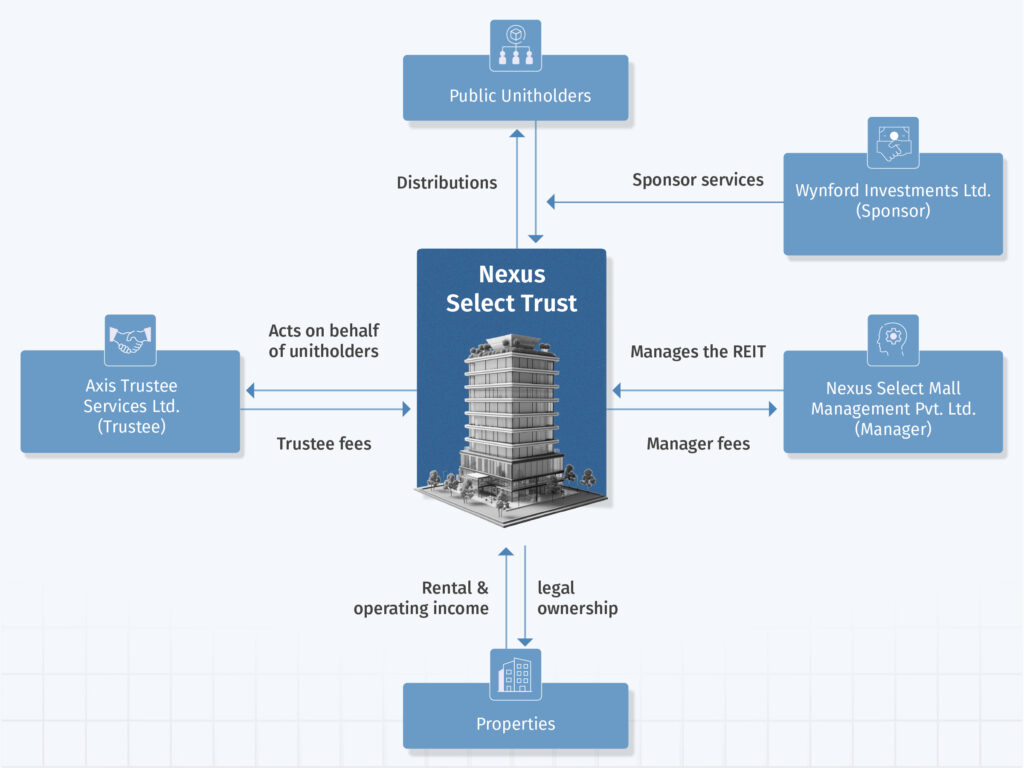

Nexus Select Trust is sponsored by Wynford Investments Ltd., India’s largest owner and operator of Grade-A shopping malls, and is backed by Blackstone, one of the world’s most respected real estate investors. Blackstone’s involvement brings patient capital, strong governance, and global standards in retail asset management; all crucial for running large, consumer-facing properties. Nexus Select Trust Management Pvt. Ltd. manages the day-to-day operations. Their focus is on steady improvement, refining tenant mix, and enhancing customer experience across malls.

Its portfolio includes key urban centres, featuring organized retail hubs rather than single-purpose malls. Shopping, dining, entertainment, and essential services under one ecosystem, ensuring the REIT isn’t dependent on any single retail category for revenue. Growth is expected to be gradual and operational, coming from better asset utilization and tenant performance rather than aggressive expansion.

Nexus Select Trust REIT structure

Nexus Select Trust REIT: Key performance highlights

In its Earnings Update Q2 FY26, as of September 2025, Nexus Select Trust REIT continues to deliver steady performance.

With a Gross Asset Value (GAV) of ₹29,252.9 crore, investors can see the scale and quality of the underlying properties. From an investor’s perspective, a high GAV indicates a well-diversified, valuable portfolio that provides a strong foundation for stable income and long-term appreciation. It also gives confidence that the trust has substantial assets backing the distributions.

Revenue rose ~13.8% year-on-year to ₹630.9 crore, reflecting how stable, consumption-driven assets can produce consistent rental income even in a dynamic retail environment. The growth points to a portfolio where tenants remain engaged and occupancy levels remain healthy.

Net operating income (NOI) increased by 14% to ₹467.5 crore. This demonstrates that day-to-day operations are running efficiently and that the trust is converting its rental revenue into real operating profit effectively. In retail real estate, NOI is a good indicator of both tenant quality and property management discipline.

EBITDA also improved, reaching ₹447.5 crore, up ~12.66% compared with the same period last year. This shows that operating costs are well controlled, even as the trust maintains high-quality properties and services.

Distributions of ₹333 crore (₹2.198 per unit) highlight the trust’s commitment to turning these operational results into tangible income for investors. Over time, these distributions reinforce why Nexus Select Trust is seen as a stable income-generating vehicle in the listed REIT space.

Key strengths of Nexus Select Trust

1. Overall growth: Since its listing in May 2023, the Nexus Select Trust REIT has shown strong capital appreciation, distributing ₹3,010 crore (₹19.853 per unit) while delivering total returns of over 80% to unitholders. This performance reflects the resilience of its retail portfolio and value creation for its long-term investors.

2. High-quality tenant base: Nexus Select Trust REIT hosts renowned brands, like GUCCI Beauty, COS, PRADA Beauty, underscoring the premium nature of its retail portfolio. Anchored by such popular brands, occupancy remains strong at 96.9%, reflecting high demand and steady rental income.

3. Diversified portfolio: The REIT’s assets span 15 cities, totalling 10.6 million square feet of leasable area. By spreading across different geographies and retail segments, Nexus Select Trust avoids overdependence on any single market or tenant category.

4. Prudent financial profile: Nexus Select Trust REIT maintains a net debt-to-GAV ratio of 18%, comfortably below SEBI’s regulatory limit of 49%. Any borrowing is structured to support income-generating operations, rather than aggressive expansion, thereby strengthening the trust’s stability.

5. Transparent and regulated structure: Investors benefit from quarterly disclosures, audited financials, and a regulatory framework that requires a high proportion of distributable cash flows to be paid out. This ensures clarity, transparency, and predictable income over time.

Key concerns to keep in mind

1. Consumption sensitivity: The Nexus Select Trust REIT derived ~16% YoY in Q2 FY2026 of rental income from its key retail categories like fashion, jewellery, beauty & personal care, entertainment and electronics. That means it’s more exposed to shifts in consumer spending than office-focused REITs. Even with a strong tenant base, slower economic cycles or inflationary pressures can affect sales and, in turn, rental collections.

2. Retail portfolio WALE: The retail WALE sits at 4.7 years, which is reasonable but shorter than office REITs. Retail leases turn over more often, creating opportunities for higher rents but also increasing renewal risk.

3. Tenant concentration and lease renewals: A few large tenants account for a significant share of occupancy and consumer traffic. Delays in renewals or store exits can negatively impact cash flows. Active asset management reduces the impact but doesn’t eliminate the risk.

4. Leverage considerations: While a low net debt-to-GAV ratio indicates a prudent financial profile, increasing leverage to fund future development or acquisitions could amplify risks, especially if consumption slows or vacancies rise. Investors should monitor debt levels and repayment schedules over time.

These points remind investors that even well-structured REITs require attention. Nexus Select Trust offers income visibility and strong operational fundamentals, but it exists within a framework shaped by tenants, consumption cycles, and financial management decisions. Understanding these dynamics ensures realistic expectations and informed portfolio decisions.

Where Nexus Select Trust REIT fits in your portfolio

This REIT’s strength lies in converting daily retail activity into a predictable income. For you, that means this REIT works differently from equities or bonds. The cash flow from long-term leases behaves like income, while gradual rental growth and operational improvements create a layer of appreciation. This approach positions the trust firmly within the income-oriented segment of real estate investing.

This trust is best treated as a satellite allocation. Even though its portfolio is diversified across regions and tenant categories, it is still concentrated in retail. That means it complements your core investments, rather than replacing them. Investors seeking predictable distributions over time find it suitable, while those chasing short-term gains or zero volatility may need to adjust expectations.

Who can invest in Nexus Select Trust REIT?

1. Income-focused investors: Retail REIT income is driven by contracted rentals, so it appeals to investors prioritizing steady cash flows.

2. Investors seeking diversification beyond office REITs: This REIT adds a consumer-driven retail layer to a portfolio, reducing reliance on corporate leasing cycles.

3. Long-term investors (5+ years): The WALE, rental escalation cycle, and redevelopment pipeline all play out over multiple years. Short-term traders will find limited upside.

4. Investors wanting inflation-linked, growth-oriented real estate: Retail rentals typically escalate faster than office leases, partly due to revenue-share components. Investors looking for inflation protection may find this attractive.

How to buy Nexus Select Trust REIT

Investing in Nexus Select Trust is quite easy, unlike direct property investments that require large capital commitments.

Listed on both NSE and BSE, its units can be purchased like any other stock through a trading account. You will find this REIT under its ticker name: NXST (NSE) and 543913 (BSE). You can start small and increase your investment over time, taking advantage of the liquidity that listed units provide.

For investors seeking additional diversification, mutual funds or Exchange Traded Funds (ETFs) that include Nexus Select Trust offer an alternative route. This can spread overall risk across a broader portfolio.

Understanding Nexus Select Trust means seeing how well-managed retail properties can provide rental income in a regulated, investor-focused framework. It can be particularly appealing if you value diversified, operationally mature retail assets. For investors who are comfortable with moderate cyclical exposure and are looking for gradual portfolio growth alongside predictable distributions, this REIT can offer a way to participate in India’s organized retail story without taking on the direct management responsibilities of owning physical properties.

Before you decide how much to allocate to Nexus Select Trust REIT, it’s useful to get perspective from a Qualified Financial Advisor (QFA). Investing is about understanding how that product fits into your broader financial life: your goals, risk tolerance, timelines, taxes, and existing portfolio. A financial advisor has the training and experience to look at all these factors together and craft a plan that makes sense for you.

Doing it yourself might seem appealing at first because it feels simple and avoids advisory fees. But managing investments well requires continuous research, disciplined decision‑making, and emotional control, especially during market volatility. You may end up making impulsive choices or reacting emotionally during downturns, which can undermine long‑term outcomes. An advisor helps prevent emotional decision‑making, and stays focused on your long‑term plan.