A recent review of the Insurance Regulator (IRDAI) and company disclosures revealed that up to 100% of the insurance commissions earned by banks may be derived from selling products of their own affiliated insurance companies. This raises concerns about the potential for mis-selling and conflicts of interest within the sector.

Why do banks in India aggressively push insurance?

According to 1 Finance Magazine’s report, India’s top 15 banks by market capitalisation collectively earned ₹21,773 crore in commissions from the sale and marketing of insurance, mutual funds and other financial products in FY24.

Commissions made from sale/marketing of insurance, MFs and other financial products (FY24)

Source: The Mis-selling Menace, 1 Finance Magazine

Over the years, banks have increasingly become key players in the insurance market. Banks accounted for 33.1% of new individual life insurance business premiums in FY24, a rise from 15.6% in 2013-14.

This growth is primarily driven by heavy commissions on insurance products sold by relationship managers (RMs), who are incentivised to push these financial products.

Source: The Mis-selling Menace, 1 Finance Magazine

However, the commission structures show that the bulk of these commissions are linked to selling policies from related-party insurers.

How do related-party commissions create a conflict of interest for banks?

The commissions paid to banks for selling insurance products, especially life insurance, are huge. According to our study, 100% of commissions banks earn from selling life insurance products are derived from selling policies of their own affiliated insurance companies.

This partnership creates a conflict of interest, as banks may prioritise pushing their own products over others, irrespective of their suitability for the customer.

Source: The Mis-selling Menace, 1 Finance Magazine

Source: The Mis-selling Menace, 1 Finance Magazine

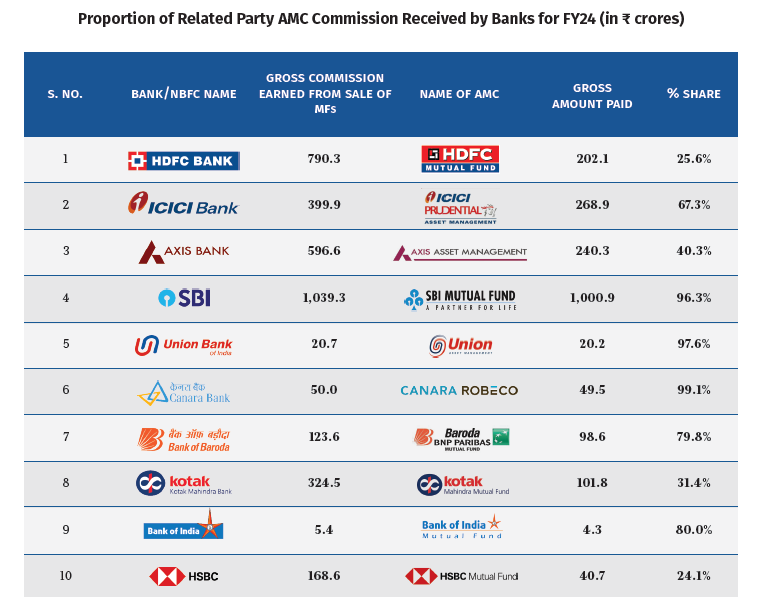

At the same time, 99.1% of the commissions banks earn from mutual fund sales come from their own related-party Asset Management Companies (AMCs), another trend of banks prioritising the sale of in-house financial products to their customers.

Source: The Mis-selling Menace, 1 Finance Magazine

Source: The Mis-selling Menace, 1 Finance Magazine

1 Finance has made a documentary highlighting the rampant mis-selling of financial products and its impact on our lives. Watch the trailer here.

An awareness initiative by 1 Finance

What is the problem with banks recommending their own related-party financial services/insurance company’s products?

When banks push their related-party (RP) financial products, the customer may end up with a sub-par investment compared to market alternatives. For example, if the bank sells its own AMC’s Flexicap fund with a 9% annual return, while the benchmark index fund delivers 12%, the compounding gap over time is massive.

On a 20-year SIP of ₹10,000 per month, the difference looks like this:

| Particulars | Related-Party Flexicap Fund | Benchmark Index Fund |

| Annual Return | 9% | 12% |

| Value After 20 Years (₹) | 67,28,960 | 99,91,479 |

| Difference (₹) | 32,62,519 | |

By choosing the bank’s related party fund instead of a better-performing benchmark option, an investor would lose over ₹32 lakhs in 20 years, purely due to biased distribution. A 3% gap may appear trivial, but over decades it compounds into lakhs of rupees lost.

What are the impacts of related-party commissions on customer trust?

Customers are often unaware that the products being recommended are primarily selected based on the bank’s commission structure, rather than their financial suitability. At times these customers are also forced to buy clubbed financial products.

For example, you might go to apply for a home loan which gets approved but you are told that the amount will be disbursed only after you purchase life insurance or another financial product through them, on which they make up to 65% commission on the first-year premiums.

The persistency ratio of life insurance policies shows that many policies are discontinued within a few years of purchase. This is indicative of customers failing to continue payments due to either dissatisfaction or lack of understanding about the products they purchased. The 61st-month persistent ratio for top life insurers averages at 51%, meaning that nearly half of all the policies sold are not sustained by the customers.

Source: The Mis-selling Menace, 1 Finance Magazine

Source: The Mis-selling Menace, 1 Finance Magazine

Conclusion

These disclosures hint that banks’ commission income is tied to their own related-party insurers and AMCs, shifting the incentive structure away from customer outcomes and rather towards institution’s profits. The scale of related-party dependence is a glaring misalignment between investor interest and distributor behaviour.

Customers must question recommendations and compare alternatives and regulators should act to rebalance incentives and enforce disclosures.