9 October 2025

4 min read

Unit Linked Insurance Plans (ULIPs) are marketed as an attractive blend of life insurance and investment. While ULIPs are intended to provide the dual benefit of insurance coverage and market-linked returns, they have gained notoriety for being mis-sold, often leading investors into unfavourable financial outcomes.

The sale of ULIPs by banks has raised concerns due to the aggressive marketing strategies used and the inherent conflicts of interest. This article dives into the practices of mis-selling ULIPs by bank relationship managers (RMs) and whether they are a good investment or not.

How widespread is the mis-selling of insurance products?

According to the Insurance Regulatory and Development Authority of India’s (IRDAI) reports, banks have emerged as the dominant distribution channel for life insurance products, contributing 33.1% of new individual business life insurance premiums in 2023-24, an increase from just 15.6% in 2013-14.

In FY24, the top 15 banks by market capitalisation made ₹21,773 crores in commissions from the sale and marketing of insurance, mutual funds and other financial products. Banks have now become commission-driven institutions, with some making as much as 25.2% of their total income from commission, exchange and brokerage income.

Source: The Mis-selling Menace, 1 Finance Magazine

What tactics may bank RMs use to mis-sell ULIPs?

- Promising guaranteed or fixed returns: When selling ULIPs, RM may guarantee returns. Despite ULIPs being market-linked products with volatility, RMs often promise fixed returns ranging from 8% to 15% annually. Such sales pitches are effective when targeting senior citizens seeking stable income sources or customers with next to no financial awareness. Regulatory bodies like the IRDAI and the SEBI prohibit guarantees of market-linked product returns. However, bank RMs circumvent this by showing historical performance data and projecting them as future certainties.

- Misrepresentation of ULIPs as fixed deposits: Bank RMs may target customers visiting branches for FD renewals or new deposits, presenting ULIPs as “special FDs” with insurance benefits. They highlight the tax benefits under Section 80C while downplaying the market risks and lock-in periods.

- Targeting vulnerable customers: Senior citizens are targeted with ULIPs as alternatives to fixed deposits, exploiting the trust and limited financial awareness of elderly customers. Rural banking customers also often are misled into buying products in the guise of loans.

Our documentary on mis-selling of financial products, including life insurance, by banks in India talks about such mis-selling events. Watch it here.

An awareness initiative by 1 Finance

- Forcefully bundling products: Customers seeking loans, locker facilities or account upgrades are often told that purchasing insurance products is mandatory or would expedite their service requests. Bundling ULIP sales with essential banking services creates a coercive environment where customers feel compelled to purchase unsuitable products.

What are the different types of ULIP charges?

The IRDAI established regulations governing ULIP charges through the IRDAI Regulations 2019. These regulations are to protect consumers by capping various charges, but the complexity often confuses investors.

- Premium allocation charges: These charges are deducted from the premium before any investment allocation, covering initial expenses such as:

- Agent commissions and distribution costs

- Underwriting and medical examination expenses

- Policy issuance and administration setup costs

IRDAI regulations require these charges to be clearly disclosed and capped at 12.5% of that year’s annualised premium.

2. Fund management charges: Charges for managing the underlying investment funds. IRDAI has capped fund management charges at a maximum of 1.35% per annum of the fund value. For discontinued policy funds, the cap is reduced to 0.50% per annum.

3. Mortality charges: Mortality charges cover the cost of life or health insurance coverage provided under the ULIP. The charge for the mortality or morbidity risk covered will only be for the pure risk charges for the cover offered and will not include any allowance for expenses.

4. Policy administration charges: These monthly charges cover ongoing policy maintenance costs, including premium collection, policy servicing and statement generation. IRDAI allows these charges to remain constant or increase at a predetermined rate not exceeding specified thresholds.

5. Surrender and discontinuance charges: Investors surrendering ULIP policies before the mandatory 5-year period face discontinuance charges. The regulatory framework caps these charges based on the policy year and premium amount.

Despite these caps, the front-loaded nature of charges means investors may see minimal returns in initial years, contributing to high surrender rates.

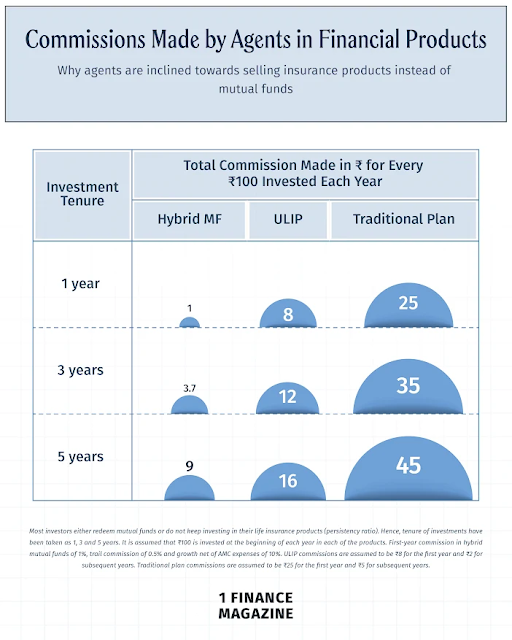

Commissions comparison of banks and mutual funds

The stark difference in commission structures explains why banks push ULIPs over mutual funds.

Source: The Mis-selling Menace, 1 Finance Magazine

As the tenure shortens, the share of first-year commissions increases dramatically for ULIPs and traditional plans compared to mutual funds. For example, over a 5-year horizon, a ULIP pays 50.0% of its total commission in year one, whereas a hybrid mutual fund pays only 28.5%.

This disparity creates powerful incentives for bank RMs to recommend ULIPs regardless of suitability. Banks can earn up to 65% of the first-year premium as commission on traditional plans, while mutual fund commissions are typically around 1% annually with no upfront payments.

Conclusion

While regulatory caps on charges have improved product economics, the fundamental incentive misalignment between distributor earnings and customer welfare persists. Banks earn 2 to 11.3 times more commission selling insurance products compared to mutual funds, creating irresistible incentives for mis-selling.

The regulatory bodies must act decisively to restore consumer confidence and ensure that financial products serve customer interests rather than commission targets.