When Mindspace Business Parks REIT made its debut on August 7, 2020, on both the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), it marked a significant moment in the market. This was not just another listing; it emerged as a key player that could impact India’s real estate investment trust (REIT) sector. Fast forward a few years, and Mindspace REIT has evolved into a formidable, income-generating real estate option, backed by multinational companies and a varied portfolio of desirable office locations. Its success shows how quickly a well-planned REIT can grow with the right assets.

If you are thinking about investing in Mindspace Business Parks REIT for the long term, this blog will help you understand its features and see if it fits your investment strategy.

All you need to know about Mindspace Business Parks REIT

Mindspace Business Parks REIT is firmly established in Grade-A office parks and high-quality commercial spaces. These include modern campuses, independent office buildings, and workspaces occupied by Fortune 500 and domestic companies across various sectors.

As of November 5, 2025, its gross asset value (GAV) is ₹41,020 crore, reflecting an increase of 11.9% from the March 2025 value of ₹36,650 crore, according to its recent report. The GAV represents the total market value of its assets before deducting liabilities.

Who owns Mindspace REIT?

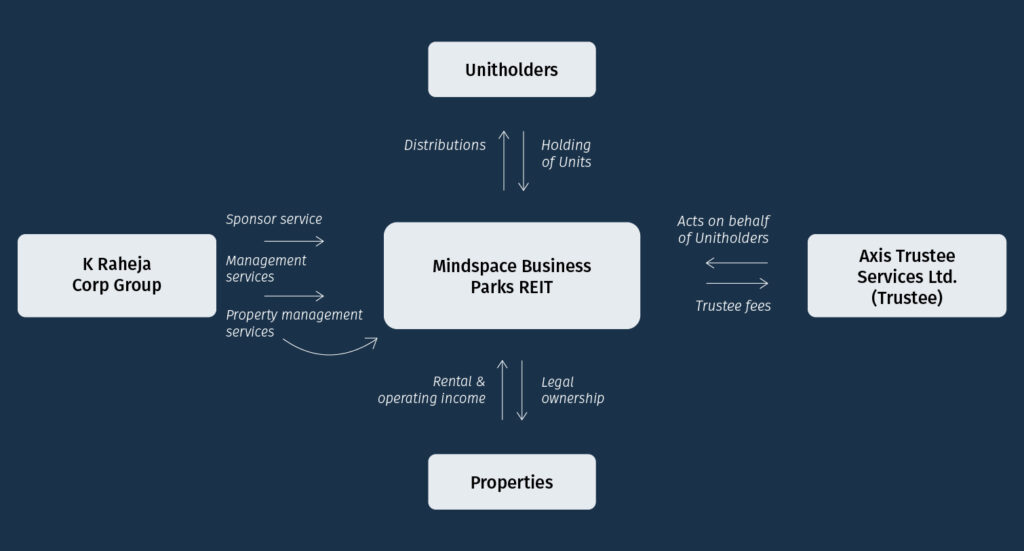

Mindspace REIT was created by Anbee Constructions LLP and Cape Trading LLP of the K Raheja Corp group. Axis Trustee Services acts as the trustee, while K Raheja Corp Investment Managers Pvt Ltd manages it. After the 2020 listing, its ownership landscape expanded, with most ownership moving to public unitholders. Today, the REIT is broadly owned by retail and institutional investors.

Mindspace Business Parks REIT portfolio highlights

The portfolio spans cities such as Mumbai, Pune, Hyderabad, and Chennai, where the demand for office spaces is high. It currently hosts global corporations including L&T, British Petroleum, Wipro, Cognizant, J.P. Morgan, and HDFC.

Mindspace Business Parks REIT structure

Read More: Different types of REITs in India

What are the driving factors behind Mindspace REIT?

The recent Q2 FY26 Report highlights Mindspace Business Parks REIT’s positive financial health with several key indicators.

Revenue from operations: The Mindspace REIT reported a revenue of ₹777.8 crore, reflecting a solid increase of 24.8% from last year. This growth suggests a robust top line, often resulting from higher occupancy rates or strong leasing activity, which bodes well for future distributions.

High occupancy rate: Mindspace REIT’s offices boast a committed occupancy rate of 93.8%, the highest since its listing. Almost every square foot of their office parks is generating rental income from high-quality tenants. For investors, this translates into consistent and reliable quarterly income.

Net operating income: The net operating income of Mindspace REIT reached ₹633.9 crore, growing at 25.8% year-over-year. This growth indicates expanding demand for the REIT’s properties and healthy leasing activity. Current rental incomes are higher than last year’s, with the potential for continued improvement.

Fundraising: According to the annual report for 2024-25, Mindspace REIT successfully raised ₹2,750 crore through non-convertible debentures (NCDs) and commercial papers (CPs) at the REIT level. This strength illustrates its financial stability, suggesting that investors are confident in lending it money, indicating the REIT is neither struggling to borrow nor overpaying for loans.

Distribution: Mindspace REIT distributed ₹355.2 crore to unitholders (₹5.83 per unit), marking a 16.3% year-over-year increase. This demonstrates the REIT’s commitment to share its earnings with investors rather than retaining them.

Overall, these figures indicate that Mindspace Business Parks REIT is generating predictable rental income, and its consistent distributions and financial strength position it for long-term returns.

Should you invest in Mindspace Business Parks REIT?

1. Strong, high-quality tenants

Mindspace Business Parks REIT hosts 270 multinational companies. When tenants are global corporations, the likelihood of default on rental payments is low. These companies tend to have long-term leases and have consistently paid on time.

2. Long-term leases

Long-term leases provide predictable income over time. With a Weighted Average Lease Expiry (WALE) of 7.4 years, rental income is secured for extended periods. This means the REIT is not frequently searching for new tenants.

3. Growth already planned

Mindspace is expanding beyond its current portfolio. With about 7.1 million square feet under construction or in the planning stages, the REIT is proactively preparing for future rental income.

4. Expanding into high-potential data centres

Mindspace Business Parks REIT is currently the only listed REIT in India entering the data centre market. The REIT has ambitious plans for three data centres totaling 1.05 million square feet, including significant projects in Navi Mumbai. This initiative adds a new layer of diversification to its portfolio.

5. Strong financial footing

With low leverage and a AAA credit rating, Mindspace REIT can borrow at attractive rates, providing a valuable advantage in the real estate sector. Its strong credit quality reflects management discipline and financial stability, which helps reduce risks for investors.

Mindspace REIT: Potential concerns for investors

1. High dependence on office demand

Currently, Mindspace Business Parks REIT heavily relies on the commercial office market’s performance. If hybrid or remote work trends strengthen, office leasing demand may decline, potentially impacting occupancy rates and rental growth.

2. Execution risks on upcoming developments

While the planned 7.1 million square feet of construction projects promise future growth, they also introduce execution risks. Delays, cost overruns, or slower leasing could negatively affect overall returns.

3. Data centre expansion risk

The decision to enter the data centre sector is commendable but comes with higher capital requirements and operational complexities. Although the outlook is positive, success will depend on timely project deliveries, attracting high-quality tenants, and establishing robust infrastructure in this competitive market.

Where does Mindspace Business Parks REIT fit into your asset allocation?

Mindspace Business Parks REIT can be the steady income component of your investment portfolio, providing reliable returns while your other investments, like equities, do the heavy lifting. Its income is highly predictable, supported by long-term leases from global corporations, which enhances its reliability. Therefore, if your portfolio is heavily weighted toward equities or mutual funds, adding Mindspace Business Parks REIT can bring balance and stability. This REIT is ideal for investors seeking quarterly income with lower volatility compared to equities, along with exposure to real estate without the challenges of managing physical property. Additionally, as rental rates typically increase over time, this REIT serves as a natural hedge against inflation.

Before integrating this REIT into your portfolio, consult with a Qualified Financial Advisor (QFA), who can assess your overall financial situation and recommend its role in your asset allocation strategy.